Dateline: 18 February 2015

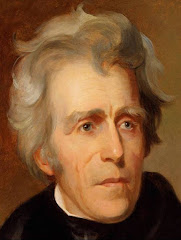

As a follow-up to My Previous Blog Post About Buying Some Cemetery Plots, I’d like to show you the headstone I’ve picked out. That’s it above.

####

On the subject of estate planning...

I was speaking to a friend recently who told me he got his financial advisor, his accountant, and his attorney all together in the same room to help figure out the details of his trust. Obviously, he has financial resources way beyond me (and he has a business much bigger than mine). He is also a lot younger than me, so I was doubly impressed that he was taking his estate planning so seriously. That’s a responsible man for you.

I told him I was in a quandry about what exactly to do as far as my own estate planning. He said that any plan, even an imperfect one, is better than no plan. That struck me as wise counsel.

Marlene and I have a will that is 34 years old. It was given to us as a wedding gift by a local attorney. Mr. Zwirn (now deceased) was a patient of the local doctor that Marlene worked for, back before we started having children (she was a medical office assistant). Mr. Zwirn and his wife took a liking to Marlene. It was a thoughtful gift.

We didn’t have any children until eight years after we were married, but the will took them into account. In the event that Marlene and I both died, my mother, the executor of our estate (which consisted of virtually nothing when we were married), would be the guardian of our children. That was an easy decision.

But when my mother died in 2003, our three boys were ages 15, 12 and 9. We were faced with a condndrum. Marlene’s mother was too elderly to care for three young boys. There was no one else we trusted enough, and felt would embrace the responsibility of being our child’s guardians.

So we did the only thing that made any sense to us— we prayed that God would keep at least one of us alive and well long enough for our boys to grow up to an age where they could legally be responsible for themselves. They are now 26, 23 and 20, so that worked out okay.

Statistically, I’ll be the first to go. With that in mind, I’d like to have an intelligent plan in place so Marlene doesn’t have to deal with any of this on her own after I’m gone. So I’ve decided that this is the year to educate myself about wills and trusts. Then I’ll go see an attorney.

When I want to educate myself about something, I look for a book on the subject. There are numerous such books. Which one is best? I did some looking on Amazon and settled on Beyond the Grave: The Right Way and the Wrong Way of Leaving Money to Your Children (and Others) by Jeffrey L. Condon.

I feel like I made the best choice. That book is an excellent introdcution to wills and trusts, and all the dynamics that enter into figuring out the best estate plan for your particular situation. The great thing about this book is that I can actually understand it. It’s not full of legaleze. It is a totally understandable discussion about what can be a very complicated subject.

What surprised (and pleased) me about this book is that it discusses all kinds of things that most people don’t know they need to know (or think they know but don’t really) when it comes to properly passing money and property to heirs (or to charities).

Mr. Condon provides some examples of mistakes he has made during his career as an estate planning attorney, and lots of mistakes that others have made. His emphasis throughout the book is on making fundamental estate decisions that keep your heirs from having hard feelings and broken relationships in the wake of your death. It turns out that this happens fairly often, or so it would appear.

Another important objective of the book is to ensure that an estate is protected such that a surviving spouse is not taken advantage of (by various situations and circumstances that often arise).

And Mr. Condon repeatedly places emphasis on seeing that financial resources get passed on to grandchildren. I like it that the author fully understands the importance of grandchildren. While children are important, and everyone loves their children, grandchildren are something altogether different in the heart of a grandparent.

I could go on about this book. I learned a lot from it. I’m sure I’ll be reading it again. But I am now reading another of Jeffrey Condon’s books,The Living Trust Advisor: Everything You Need to Know About Your Living Trust .

.

20 comments:

That is certainly something we need to look into since my parents wishes were to pass family lands to the grandchildren through us.

One day, after you're gone, I'll reverently lay a pile of laundry on your grave.

Along with a plucked chicken.

As for estate planning... part of me worries about having everything written down legally. It seems like a safer idea to just give my firstborn a treasure map that takes him to a place where I've buried a cache of Star Wars figurines, pawn shop guitars, seeds and a signed postcard from Groucho Marx.

Herrick we've planned our estate & written wills a couple of times. We'll be updating all of it again again some here in the near future.

I also wrote my obituary years ago. I do update that too every so often.

It's amazing how a plan or intentions that are solid can change as the years pass.

Guess that's a natural part of growing old :-)

I am dealing with my father's estate. He did have a will but since it was 35 years old, I still ended up in probate.

Numerous challenges. Wrong social on the death certificate. Wrong health insurance info inadvertently given out and then had to be corrected. Lived 800 miles away. A commercial size garage full of cars, tools and equipment that had to be dealt with and disposed. A house that was perfect for him and maybe two or three other like-minded people on the planet but one that isn't selling, so guess who is stuck with the mortgage, insurance and taxes!

So, I hounded my mother to get a will, which she has done but her finances are more complicated. I'm worried that a majority of her retirement income is in investments. I can't convince her that fecal matter is coming. She will lose it all likely as not.

And I'm glad to hear you are still vested in a "normal" future. I think it's good to plan for all scenarios as best as you can. You never know...there may be some hail mary move that changes everything in a positive direction. Okay, I don't really believe that, but...you never know.

Thanks for keeping us grounded.

Respectfully, Pam Baker

One of the most important things you can do for your family! I know, my husband passed away July 2013, and if he had not taken the plan that gave me 2/3 of his retirement income, I would have been in the street. He could get a much larger amount if he had chosen just himself, and we would have been fine, but he went for the "wife" offer, and believe me, it saved my life. Actually, God did, because I know my husband would do as the Lord led him.

We lost everything he worked 31 year for, including our home, when he had a stroke, and eventually heart surgery. we had a wonderful home that ended up in bankruptcy after 20 years of paying on time, all because of medical issues. Hundreds of thousands of it! My only prayer was to leave my husband with me, and take everything we owned, He did, and I have no regrets at all. The last years were just wonderful. I am right now making a list of what I can do with some property, and my own funeral, and it is SO important to do it RIGHT NOW! no waiting. If I didn't have the retirement fund, I would have been on the street, I decided to apply for disability social security, and for my husband it took over 6 months to get it. Without a dime, you will be in a real trauma for sure. Additional health insurance is a MUST, no matter how healthy you are. Today a stay in the hospital can run you thousands of dollars a day. They WILL take your property, home or anything they can if you can't pay. This is the new money system and I believe is why we all have to get insurance. No money, no home. I have done huge studies on this, trust me, it's real. Put money aside for property taxes too. Your family will need it. A lot of it. Great post Herrick, and really important for everyone.

Herrick:

As you now know, a will is a guaranteed probate. A trust is a better vehicle for dealing with the issues of disability, survivorship and end of life. I would also encourage you, once the trust is established and funded (impt), to prepare a "loving will"--a document to tell your children and grandchildren about the values and lessons you have learned in life that you would like to see passed onto them. This last item they will cherish, much more than the stuff.

Gail—

That is good of you to be so respectful of your parent's wishes. As the Jeffrey Condon book makes clear, this often doesn't happen. But there are ways that grandparents can help to make sure it happens.

The idea of passing on a piece of family land really appeals to me. I know a family that has 100 rural acres near me. The mother is elderly but healthy and lives in a home on the property. Two sons and a grandson, with their families, also have homes on the property. They recently put the land and real estate into a family land trust of some sort. The idea being that the land will be protected from various kinds of legal seizure and it will pass on through the generations without any probate issues.

When this woman and her son were telling me about putting the land into a trust to preserve it, she said" "You know what Malcolm X said about land, don't you?"

I had to admit that I didn't and she replied, "He said that land is the basis of freedom."

I was impressed. This woman, and her family knew that the ownership of a piece of land is fundamental to true freedom, and she had invested the money into making sure her family would always have land to live and homestead on (they are down-to-earth people).

As for Malcolm X, I knew nothing about him aside from his name and the fact that he was a black activist. I decided to watch a documentary. He was an interesting person. His father evidently had independent, agrarian understandings about freedom, and they must have had an impact on the son.

David the Good,

Re: the laundry and chicken... That would be Good of you.

Re: the treasure map to a cache of "undeclared" valuables.... You and I think very much alike. :-)

Granny,

I well remember the blog post in which you told of writing your own obituary, and making other end-of-life preparations.

I have since heard of one person I know who has written his own obituary.

And I happened to read a pre-composed obituary in the local paper that made me think of you. The deceased began by writing, "I kicked the bucket on..."

Pam—

Sorry to hear of the troubles you are having with your father's estate. It can be a real quagmire to deal with all the stuff and the legalities.

Lawyers make a lot of money probating estates. That was made clear by the Condon book. And it is proving to be true with my mother-in-law's estate. She had only a house and a little $ in a CD. It will be divided between her six children... and the attorney. He will end up getting about the same as the six siblings.

I don't know if I'm vested in a normal future as we have known normal to be. I'm fully expecting a new and radically different "normal." But I'm going to proceed for now on the assumption that some aspects of the rule of law associated with estate planning will be retained.

Nothing will surprise me though, and I'm quite certain that the government will do everything it can in the years ahead to perpetuate itself by taking more and more money from everyone who has any. That would include more clever and oppressive ways of taking from heirs and the estates of deceased people.

Which makes David Good's idea of a treasure map and buried cache all the more intriguing.

Thanks for the comment.

Don—

Yes, all wills are probated. Trusts are not, and they sure do have a lot of advantages. Jeffrey Condon makes that abundantly clear in his book.

Loving will? First I've heard of it. I like the idea.

One would HOPE that the heirs would appreciate such a document, but it would depend on the heirs. I think the average heir would be far more interested in the money. That is human nature.

The Condon book really focuses on human nature and the sorry scenarios that often play out in families when money is involved.

Sheiia—

Your experience is, unfortunately, becoming more common, and it is something I think about quite a bit.

Personally, I'm hoping for a heart attack that will take me quickly, but not any time soon. I need to figure this estate thing out first. And I'd like to see one of my children take an interest in my home business, so they can help Marlene run it when I go. The home business is our retirement plan.

I'm glad your husband did the right thing for you with his retirement plan. That is, of course, what any responsible man would do. And I'm also glad to know that you are doing well under the circumstances.

Thank you for the comment and the admonition to others to do the responsible thing when it comes to these critically important matters of life.

Loving wills can be found at ownershipadvisors.com, where examples are provided.

Something you may not find in books.

Ask yourself what are your goals -- probably to live comfortably in retirement and pass onto your children what is left over. Maybe some land you care about.

Do you trust your children? If so, start giving your estate away today with the moral proviso that if you need it they will give it back.

By the time you get to the end there will be no estate to worry about.

This does not work if your kids are bad and you do have the legal risk that they go bankrupt (could be from financial or accidental reasons) but it sure does make planning easier as there is only realtime planning, no estate planning.

Hi Jim,

Thanks for the comment. Jeffrey Condon's book does focus on and recommend passing money on to children and grandchildren with yearly gifts over a period of time. There are a lot of advantages to that, assuming that the estate has the financial resources to pass on. But there are disadvantages too, and he certainly points out the disadvantages.

When it comes to real estate (e.g., a home) Condon warns repeatedly about not signing a personal home or income property over to any heir in an attempt to avoid probate (outside of putting it in a trust). And he provides lots of reasons and examples why this is a foolish move. Bankruptcy of the heir is only one reason.

Your idea of giving a whole estate to one's children, with the proviso that they give it back or provide for your needs later (if needed) is great in theory. But it would, as you say, require "good" children, which is to say, children of exceptional character, maturity and fiscal responsibility.

Even then, it would be a risky thing to do for all the same reasons that it isn't a good idea to give over your home. There are numerous scenarios that would disrupt the plan.If the child or children have a divorce, there would be significant complications and loss. Same goes for IRS problems, being sued, and other things I can't think of right now.

Herrick, These are some of the same issues I'm dealing with. I have 4 children, and 2 of them have recently lost jobs, and are living on half of what they used to make. With situations like that to think of, it makes it harder to make decisions. They both had to move in with me until they were settled again, and they are quite responsible too. So even if your children are "Good" children, and wise about finances, that is no guarantee that problems won't happen. It opened my eyes to being sure of the decisions I make for the future. I desire my children to have my property, however the laws of this country are so insane today, no one knows where the gov. is taking us. So, I simply decided that I will do the best I can, and learn, however to me, the only hope anyone in this world has today, is the Lord. I have trusted Him with my life, all my life, and there is no better way to handle it. Learn, and trust that He will show you the way. The world is His to pass on, or not, and that is the truth of it all. He will do what is best for us, of that, I am sure.

PS I finally purchased the book. Thank you!

Sheila,

I agree. Thanks for the comment.

Post a Comment