Dateline: 16 January 2015

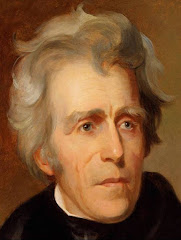

My mother-in-law, Evelyn Myers, died last July (my eulogy is HERE). She lived in a simple home (pictured above) on a quiet side street in the village of Moravia, New York. The house has been for sale nearly 6 months, and now has a buyer.

A woman named Emma Westfall had the house built for herself back in 1976. It was built by a local company named Slade and Sovocool. The farmer I worked for back in high school used to refer to Slade and Sovocool as “Spade and Shovelfull.” Funny the things we remember.

Slade and Sovocool doesn’t build houses any more. The business is now a hardware store, owned by Mr. Emmet Sovocool. Mr. Sovocool is up in years but he's a sharp man, and runs the store with the help of his family. His son, Bob, was in my class in high school.

Mr. Sovocool once told me that the stretch of land on West Cayuga Street, where his store and several other businesses are located, was the farm he grew up on. When I drive down that way I often try to imagine the farm as it was, right there on the edge of town.

Though I did not know Emma Westfall, I know that she was not married, she lived into her 80's, and the story goes that she had a lot of money—a fair amount of which she left to the Methodist Church. Investing in the stock market was her hobby. I have no idea how I know these things.

This is, after all, small rural town. People just know. And if they don’t have the story exactly right, it’s pretty close.

When Emma Westfall died, the house was bought by Kevin Genson, who is one of Roy Genson’s sons. Roy owns Genson Overhead Door company. He started the business in the garage next to his house. The business grew, eventually moving to a larger, more official location in a neighboring town.

It was Kevin Genson's brother, Greg, who killed the bull that came down into town from Owasco Meats, up on Oak Hill road, a few years ago. The cops shot the bull and just made him mad. Greg Genson met the beast in his back yard and put him out of his misery. I wrote about that episode of Moravia history here: How Not To Shoot The Bull

What I like about the Genson family is that Roy started a business, taught his sons how to do the work, and it is now a family business. It's a family economy. Click Here to see a picture of the Genson family.

Anyway, Kevin Genson fixed Emma Westfall’s house up, lived in it a short while, and listed it for sale. Evelyn’s husband, Jay, had recently died and she wanted to move into town. The house was perfect. She bought it. I don’t think it was on the market for even two days. That was 1997. She paid $70,500.

The house is on Donald Drive, which is a cul-de-sac of relatively new homes. The land was once the back yard lot of a large old house on Main Street that was owned by the Donald family. The Donalds had a nursery. They had greenhouses and gardens on the land. That was before my time.

One of the Donald girls, Hilda, married Jay Myers’ brother, Victor. So Hilda was Evelyn’s sister-in-law (or Marlene’s Aunt). Aunt Hilda and Uncle Vic lived in the big house all their married life, until Uncle Vic died and Hilda decided it was time to move into Millstream Court, the senior citizen’s apartments.

Aunt Hilda was a perky woman who took up oil painting in later years. One of her paintings (a farm scene) is on the wall by my computer. She was a surprisingly good painter. She passed on a few years ago.

Aunt Hilda once told me that her father used to sterilize soil for the nursery by packing the soil in a box, around a long length of coiled-up radiator hose. Then he hooked the hose to the radiator of a motor vehicle and let the hot water circulate through the hose for a period of time. I thought that was pretty clever, and I’ve never forgotten it.

Donald Drive is, in my opinion, the best location in the village to have a small retirement home. It was perfect for Evelyn for the last 16 years of her life. Pleasant setting. Quiet street. Thoughtful neighbors.

Marlene and I actually thought about buying the house. It would be a good place to park some cash, and Marlene could live there after I kick the bucket. But I didn’t have the cash to spare, and the house really needs some updating.

Word has it that a local woman is buying the house for $72,500. No bank financing is involved. And she has people lined up to go right in and start remodeling once the sale is finalized.

It was good news to hear that the house has a buyer. The selling price is less than was hoped for, but not that much less. The family is glad to have a buyer. I think that is the usual attitude when there is an estate to be settled.

I’ve made a short story much too long (though I could have made it longer) before getting to the whole point of it...

Marlene told me about the sale of the house and said something to the effect that it is selling for $2,000 more than her mother paid for it. So, at least it didn’t lose any value.

Well, I’ve been thinking about financial repression quite a lot lately, so I couldn’t help but go to the Online Inflation Calculator....

What the inflation calculator tells us is that, as a result of inflation over the past 16 years, the house did not increase in value by $2,000. It actually decreased in value by around $30,000.

If the house sold for $102,138.93 it would have simply maintained it’s value, and anything over that would have been a true increase in value.

When I say value, I am talking about the buying power of the dollars. As the inflation calculator shows, the value of our American dollars has declined by 44.9% in 14 years.

Some people think of their home as an investment, and if they sell at a later date for more money than they put into the place, they think they have made a profit. But, in order to make a true profit, your investment must outpace inflation. The inflation calculator tells the real story.

But almost nobody looks at investing with financial repression in mind. The numbers are too depressing.

=====

P.S. I have never looked at my home as an investment. It is, first and foremost, a place to live (out in the country), to raise my family, grow my garden, run my home business, and exercise a degree of personal freedom. Such benefits are worth more than money to me.

12 comments:

I have a hard time getting people to understand what you explained so nicely. People talk about how low wages were nearly a hundred years ago without realizing that one could go to a bank with 20 dollars and get nearly an ounce of gold with it. The dollars is being debased to keep the debt based economics going but it can only go so far before it gets noticed by the sheep.

I'm not sure that real estate is a good example of financial repression. The old "location, location, location" mantra has a lot to do with it. We bought a 1008 sq ft home in 1991 in Mt Vernon, WA for $80,500. We sold it in 1994 for about $104K. My husband recently found that it had sold in 2004 for over $200, and was on the market again for $150K. So what is the true value of the home? Next to us in a tiny town in Iowa, a HUGE 3 story home, probably built by a very wealthy family was sold at auction for $40K. In a city surrounded by similar homes it would probably have been sold for $500K. Location and condition of the home affect it value tremendously, as well as what the whole market is doing. I understand the principles you are talking about, but don't think RE is a good example. We bought a our home for about $48K; it was built in 1922. To build a similar home today would cost about 10 times that, because of the oak floors and the beautiful wood trim and staircase. Am I missing something in your explanation?

Hi Rozy Lass,

My example here is all about inflation, and not the price of a home. Inflation is one component of financial repression. The government, via the Federal Reserve, has stated that they like to have an inflation rate of around 2% a year, and they manipulate the economy with that goal in mind. It's an intentional inflation that destroys people's savings, whether in a savings account or in a home—but not always.

Yes, real estate prices are fickle, and location is important when it comes to real estate values. But my point here was simply to show that, in this instance, when the home appeared to hold it's value, and even increase in value a couple thousand dollars, those dollars have significantly lost their buying power.

So, in this instance (and so many others) you can't come to proper conclusions by looking at the dollar amount. You have to figure in the actual buying power of the dollars.

In the instance of your home, purchased for $80,500 in 1991, and sold in 1994...

According to the inflation calculator, there was an 8.8% cumulative rate of inflation during that time period, and your home would have needed to sell at $87,592.51 to pace inflation. So it turns out that you outpaced inflation (by around $17,000). Good for you!

The $200,000 sale price (purchased at $104,000) for the years 1994 to 2004 (27.5% inflation) shows an inflation-adjusted value increase of $68,000 for the sellers. Good for them!

You ask what the actual value of the house is. I would say the actual value is what someone sells it for. But that is beside the point.

The point is that the sale amounts can be very deceiving and they do not necessarily tell the true story. Inflation needs to be figured into the equation in order to get a true reckoning.

Thanks for the comment.

Herrick,

Would you not factor in the value that your mother-in-law would of paid out if she had rented the house instead of owning?

For example $500 per month x 18yrs = 108K.

I'm trying to say that she would have had to pay to live somewhere, so shouldn't this money be included in the calculation?

Regards David

Thought provoking post.....thank you!

Hi Herrick, My Dad signed my house over to me in 1975 with a quit claim deed for $1. It was built by his father in 1915 for $918! Neither one of them ever had any intention of selling it for a profit. Like you they, and I always knew it would be the place where they died and SO FAR,that is what happened.

In the time from 1975 till now the price of land on this little Island has skyrocketed to obscene values. This place right now, even being 100 years old, is assessed at a value of 1.85 MILLION $$$!

But like my granddad and my father, this is where aI shall expire. This house and grounds is where I grew up except for the 22 year hiatus I spent in the USN.

It goes to one of my sons and hope he will give it the same reverence that his most immediate ancestors have.

Great post by the way.

Anonymous,

Yes, that could be included in the calculation. Along with taxes, and the new roof and other repairs that she paid for over the years.

But I wanted to simply illustrate the affect of inflation over 14 years, using the inflation calculator.

Hi Everett,

That's quite a story.

For fun, I put your numbers into the handy-dandy inflation calculator. $918 in 1915. The cumulative rate of inflation from 1915 to 2014 is 2,238.1%. And it tells us that, o pace inflation, the property would have to be worth $21,464.02.

So, from an investment point of view, your property has far, far outpaced inflation. But it doesn't mean much if you don't sell. Except for the fact that you have to pay taxes on that amount.

Yes, I hope your son will value the place as you have.

If I recall correctly, you told me your family long ago once owned a good portion of the island. That is neat. How come they don't call it Littlefield Island?

I Google-searched the real estate for sale around you awhile back and found just the right place. But it was well over a million.

You live in a very nice place!

Follow-up thoughts...

Everett's comment has me thinking that I should confess that I did not write this blog post so much about interest rates, inflation, and investing as I did about the beauty of being rooted in a community ("place" as Wendell Berry often phrases it) for a lifetime.

According to one article I read on the internet, the Average American moves 11.7 times in their lifetime. To stay in one place for a lifetime (as is the case with many people in this blog post, including my wife), or for most of a lifetime (as is the case with me), is something unique and special in our transient modern age.

When you live so long in one place, you become woven into the fabric of the community. You not only know its history, you become part of its history. You share commonalities with the people and places of the area.

This sense of belonging to a place is what keeps me here even though New York state has such high taxes and is becoming so oppressive through it's regulations on freedom-loving people.

I'm sure anyone reading this who is rooted in this kind of small-town and rural community life (like Everrett) can relate, and could ramble on at length about their connections with the people, and places, and history of their area.

Thanks for the link to the calculator. What an eye-opener! I especially like your P.S. comment. It's good to invest in hopes of a dollar value return, but investing in family is far superior. That's what the real investment in house-buying is all about. At least, the house in which you intend to build your home.

Herrick I know what you mean about being rooted in a small community. The Mr. & I are talking once again about selling the farm and taking on a smaller place in another state. We're getting too old to keep up so much. And the fact is should my Mr. up and die unexpectedly (or even with a warning) I'm selling and moving to town.

The people we love and the sense of place are the only reason we've stayed so far.

Hi Herrick. Inflation can be insidious, particularly at a time of low to zero interest rates. Ideally, though, and most of the time, you can earn interest on your savings at a rate that exceeds inflation. Not currently!

I do want to correct your math. Your inflation calculator says that to buy $1 worth of goods in 1998 today would cost $1.449. Another way of saying that is what you can buy today for $1 would have only cost $.69 in 1998 ($.69 x 1.449 of inflation=$1). So our dollar hasn't been devalued by 44.9%, more like 31% over 14 years. Not insignificant, but not as severe as a 45% drop in value. The average rate of inflation was 2.6% per year over that period.

FYI, at the beginning of 1998 rather than buying that house someone could have bought a 10-year Treasury Bond backed by the U.S. government that would have paid interest of about 5.7% per year which clearly would have been a better investment!

Post a Comment